Introduction:

The month has reached its 28th day. You have been waiting since morning to receive your salary notification. Your rent needs to be paid. Your groceries are almost gone. You check your wallet but then you remember that your salary gets deposited to your RPay card.

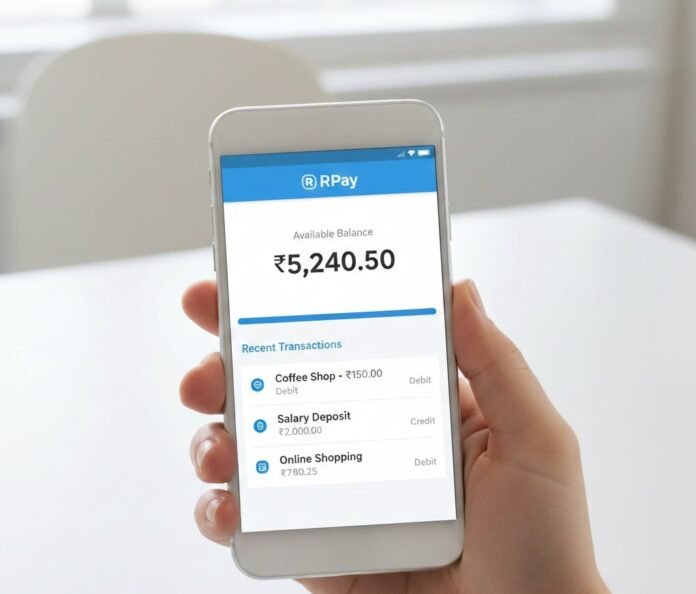

You check your phone to remember “How do I check my RPay balance again?”

UAE workers who receive salaries through prepaid payroll cards probably know about RPay salary card service which Al Rostam ani International Exchange offers as part of Al Rostam ani Group.

I will explain RPay balance inquiry from online balance checking to fee structure security features and advantages and limitations and practical financial guidance. All types of workers from blue-collar to office professionals and employers who handle payroll will find this guide helpful.

What Is RPay? A Quick Overview

RPay operates as a salary card system throughout the UAE which serves employees who lack access to standard banking services. Workers receive their salary payments through a prepaid card system which Al Rostam ani Exchange implements instead of bank transfer payments.

The following groups widely use this program:

- Construction firms

- Agencies that provide domestic staff

- Small and medium-sized enterprises and large corporations

- Companies that operate in logistics and transportation

- Organizations that use UAE WPS for employee payments

- The card functions like a debit card. You can:

- Withdraw cash from ATMs

- Pay at retail outlets

- Shop online (if enabled)

- Transfer money (in some cases)

But the most important daily function?

Checking your RPay balance.

Why Regular RPay Balance Inquiry Is Important

Financial stress affects many people according to research evidence from financial wellness assessments which reveal that 60 percent of workers encounter financial anxiety each month. The primary reason for this issue is that people do not understand their cash flow situation.

Here’s why regularly checking your RPay balance matters:

- Salary Confirmation

You must confirm that your employer has paid your salary.

- Fraud Prevention

The system helps you to find any invalid transactions that occur.

- Budget Planning

You can monitor your spending to control your rent expenses and grocery costs and money transfers.

- Avoid ATM Declines

Most people find checkout declined transactions to be their most embarrassing moment.

You should see balance inquiry as a financial discipline activity instead of considering it an insignificant task.

How to Check RPay Balance (Step-by-Step Methods)

There are multiple methods available to perform RPay balance inquiry throughout the UAE. Let us break down the methods into clear categories.

1.RPay Balance Inquiry via ATM

This is the most common method.

Steps:

- You must insert your RPay card into any ATM machine.

- You need to type your PIN code.

- You need to choose the option “Balance Inquiry” from the menu.

- Your available balance will appear on screen.

- The system allows you to print a receipt which you can use for future reference.

Important Tip:

A few ATMs charge users a small balance inquiry fee according to their specific network system.

Best For:

Workers without smartphones

Workers who need to check their balance while they withdraw cash.

2.RPay Balance Inquiry Online

Many users prefer checking their salary card balance online.

The official Al Rostamani Exchange portal allows users to log in with their credentials by entering:

- Card number

- Registered mobile number

- OTP (One-Time Password)

- The system provides you with:

- Available balance

- Transaction history

- Salary credit details

- Why Online Is Better:

- No ATM fees

- The system provides complete tracking of all transactions.

- The system enables users to access services at any time throughout the day.

- This option works best for users who feel comfortable operating their mobile device.

3.RPay Balance Inquiry via Mobile App

Al Rostamani Exchange offers customers the ability to access exchange services through digital payment methods.

- The mobile platform allows users to perform the following tasks:

- Instantly check their account balance

- Access their complete transaction record

- Monitor their salary payment schedule

- They have the ability to send money overseas.

Real-Life Example:

Ahmed worked as a delivery driver in Dubai. He used to check his salary by visiting the ATM machine. He can now check his salary within 10 seconds. He uses his phone to check his salary and then sends money to his family.

People spend less time when things become easier because they use less time to finish tasks.

4.SMS Balance Inquiry

Some salary card services provide customers with the ability to verify their account balance through SMS messages.

- You send a specific code to a designated number and receive:

- Your current available funds

- A record of your most recent transaction

- The service becomes accessible based on what the employer has organized for their staff.

Understanding RPay Transaction Details

When you check your balance You might see terms like:

- Available Balance

- Ledger Balance

- Pending Transactions

Let’s simplify:

- Available Balance

- You can use this amount of money right now.

- Ledger Balance

- The total amount of money includes all transactions that are yet to complete.

- Pending Transactions

- The payments are still in the process of being completed.

- Understanding these prevents confusion — especially right after salary day.

Pros and Cons of Using RPay Salary Card

Pros

- You don’t need a conventional bank account for your financial needs.

- Employers can use this system to distribute salaries in a straightforward manner.

- UAE stores accept this payment method at many locations.

- You can take out cash from ATMs without any difficulty.

- The prepaid format prevents overspending by controlling your budget.

Cons

The banking system provides customers with limited functionalities.

The bank charges customers for ATM cash withdrawal services.

The system does not create credit history for users.

Some online transactions may be restricted.

Most employees gain more advantages from work than they experience through their work limitations. This occurs because they cannot use regular banking services.

RPay for Employers: Why Companies Prefer It

- Employers in the UAE must comply with WPS regulations.

- Companies use RPay to process their payroll operations.

- The system helps companies to complete their salary payments.

- The system enables companies to handle their financial obligations.

- The system provides administrative staff with a solution to their operational difficulties.

RPay vs Traditional Bank Accounts

Here is a quick comparison.

Feature RPay Salary Card Bank Account

Account Opening Easy Requires documents

Monthly Fee Often low/minimal May apply

Online Banking Limited Full features

Loan Eligibility No Yes

WPS Compliance Yes Yes

A bank account proves more beneficial when you need to develop your financial abilities for a long time. RPay delivers effective salary access for immediate cash requirements.

Tips to Manage Your RPay Balance Wisely

The first step requires you to verify the balance. The second step involves executing intelligent management of the balance.

Here’s what I always advise:

Check Balance on Salary Day

Confirm correct credit amount.

Avoid Frequent ATM Withdrawals

ATM fees add up.

Keep Emergency Buffer

You should not take out your entire salary at one time.

Track Spending Weekly

You can use basic note taking to track your financial activities.

Enable SMS Alerts

You will receive immediate updates about your account.

Financial awareness begins with small habits.

The Bigger Picture: Financial Inclusion in the UAE

- Salary cards like RPay provide essential support for people to achieve their financial goals.

- The UAE hosts millions of expatriate workers. Many of them:

- Do not have bank accounts

- Work in sectors with limited documentation

- Send remittances regularly

- Prepaid payroll cards bridge that gap.

- The service delivers:

- Secure salary access

- Cashless payment options

- Safer alternative to cash envelopes

- In a way, RPay isn’t just a card — it’s a financial access tool.

Conclusion:

Let me leave you with this:

People achieve better control of their finances by learning how to handle their current possessions.

The process of checking your RPay balance leads to three important benefits. You gain understanding. You develop self-control. You avoid encountering unexpected financial situations.

If you’re an employee:

- Make balance checks a monthly habit.

- Understand fees.

- Protect your PIN.

- If you’re an employer:

- Educate workers about digital balance checking.

- Promote secure usage practices.

- The year 2026 requires everyone to have financial knowledge as an essential skill.